How long does it take to turn around a struggling Assisted Living building?

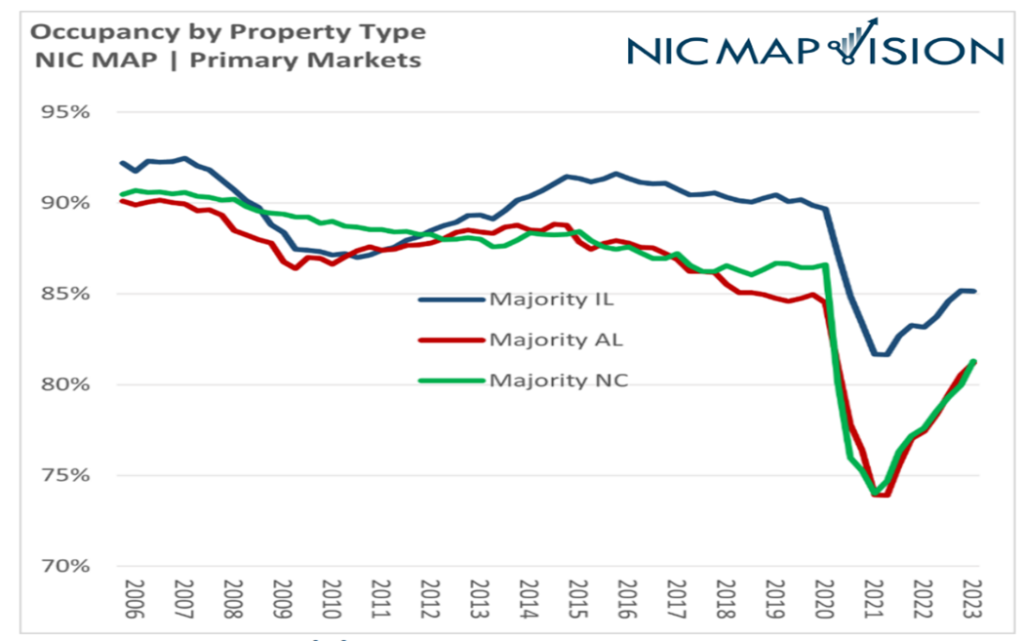

The pandemic and recent economic and demographic trends have led to widespread financial hardships in the Assisted Living market. Many owners and operators facing rapidly depleting reserves are desperately seeking turnaround plans that to achieve or return to profitability. To properly prepare and budget for a successful turnaround it is important to understand the process and be realistic on the amount of time and money that would be required.

So how long does it take to turnaround a struggling Assisted Living building?

The problem – It’s about occupancy. Most of the time.

The most common reason an Assisted Living building struggles financially is low revenue from poor occupancy, poor rates, or both. While occupancy will make the biggest and fastest contribution to revenues it should not be primarily driven through discounting and a plan to ensure rates are aligned with the market must also be considered.

Leading into the covid pandemic, the senior housing industry was excitedly preparing for the unprecedented demand from the forthcoming great silver tsunami of aging baby boomers. New buildings were being built at an unprecedented pace while very low interest rates and overly optimistic proformas drove valuations to stratospheric heights. Many of the newly built buildings found themselves in trouble upon opening. Construction and operating costs were higher than expected and the surge in demand was slow to materialize in part because of the shock of the pandemic.

The industry is now finding itself rife with buildings that are underwater while the patience of lenders and investors is rapidly running out. A turnaround is urgently needed.

The solution – Rethinking and retooling is not an overnight process.

Technology is not the answer!

While the industry is benefiting from technological innovation on many fronts, including sales and marketing, a potential resident’s decision to move into your Assisted Living is not done by a click on a flashy ad that keeps popping up at the bottom grandma’s Candy Crush screen. It is a result of a lengthy, often unpleasant process that requires substantial hand holding by your sales team. A real-life relationship needs to be built to develop trust and understanding. That is the only way that your potential residents’ true issues and concerns will surface and can be directly and productively addressed. The resident and their family must trust the humans that will be taking care of grandma.

Over-investment and overreliance on “paradigm shifting” technology solutions have shifted many operator’s paradigms into bankruptcy.

Discounting – Is it worth it?

It is tempting to offer discounts and other incentives to increase move ins, and while these often yield positive results in the short term they are fraught with danger and can cause longer term damage to your building’s profitability. We have found that too frequently, discounting programs spiral into dependency that hurts revenues as the sales team push for steeper and more permanent discounts. Meanwhile existing residents who find out about the discounting become upset and request similar incentives. Temporary discounting and incentives are certainly a useful tool that can be used sparingly to encourage activity, but they must be tightly controlled and have a finite timeline. Discounting is not the solution. Your focus must remain on finding and developing your referral sources and nurturing your lead database to drive quality leads that will pay the market rates.

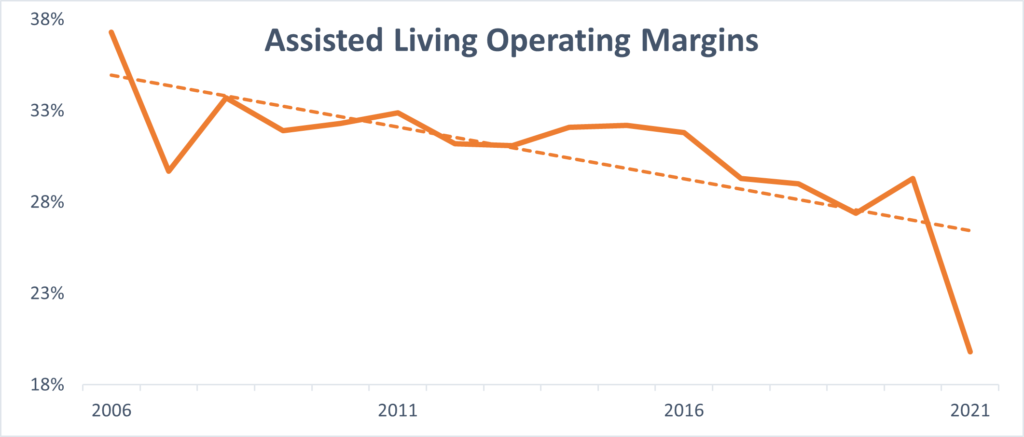

Cutting costs – A death by a thousand cuts

When looking at financial statements with a negative bottom line, brokers, bankers and trained spreadsheet wizards will all tell you that there is “fat to trim” and that there are so many expense line items that offer opportunity for slashing and HUGE cost savings. Unfortunately, the reality on the ground is different. Costs have risen sharply due to changes in the labor market, supply chain disruptions, and widespread inflation. These shocks were rapid and are largely permanent while the necessary rise in rents is more gradual. Trying to cut your way to profitability will likely cause a deterioration in the quality of services provided and lead to operational issues, reputational issues and ultimately harm the occupancy and revenues of the building.

Operating margins have shrunk and their recovery to historical levels will be slow, if it ever happens.

- Would you cut staffing costs? – Your staff is your most important asset. Their job satisfaction is paramount to their job performance and there is no way better to destroy job satisfaction than by underpaying and overworking your staff. Certainly, staffing costs are your largest expense and need to be properly managed to reduce and eliminate agency usage and maintain appropriate staffing level and wages. However, optimizing staffing costs is a lengthy process of hiring, firing, promoting, training and other adjustments. Simply looking at financials and ascertaining that staffing costs are too high and in need of reducing costs is akin to reducing the amount of oil in your car’s engine to save a little bit of money. You may save a little bit of money, but your engine may explode!

- Would you take units offline to reduce expenses? – If your building is struggling with occupancy, your banker may be tempted to tell you to shut down a wing of the building or moth ball some units to reduce costs. The unfortunate reality is that most operating costs are fixed and will not fluctuate materially based on how many units are operating. Savings from reducing your unit count would be minimal. You will also be sending a very negative message to your residents, staff, and prospects. Is our ship sinking?

- Will reducing food costs by $2 a day save your building? While expenses must be monitored and kept controlled, the majority of cost cutting measures will not create the necessary change needed to take a money losing building into profitability. The energy and costs needed to identify and implement these cost-cutting measures would be better spent focusing on increasing revenues. Revenue generation should be the primary focus, rather than picking up pennies in front of a steamroller.

Too often, at the direction of financial stake holders cost cutting is the first priority. This usually is disastrous to quality of service and staff moral leading to resident and staff complaints, regulatory issues all of which harm sales and revenue generation while also consuming massive amounts of management time further diverting attention from revenue generation. The successful turnaround involves many counter-intuitive decisions to finesse the revenue side of the business first and foremost.

You cannot save your way into a profit.

The answer – Longer than you hoped!

Recognizing that the status quo is not working and drastic change is needed is a necessary first step towards turning around the performance of the building. The current path is clearly not working well enough as indicated by the quickly depleting cash reserves. Retooling a struggling Assisted Living to position it for a successful operational turnaround almost always requires a shift in approach and a sharp refocus on what is most important: getting more residents into the building.

Driving gross revenue is more important that attacking operating margin especially in the short term. Bringing more cash through the door is the fastest way to achieving cash flow break even which in turn will give you the breathing room needed to be able to focus on adjusting operating expenses and improving margins. Therefore, focus initially should be on Sales.

The first step is to assess what parts of your sales process are failing. An assessment and verification that can take 30 to 60 days.

- Is your sales team proactive or are they waiting for the phone to ring?

- Are they urgently and persistently chasing qualified leads?

- Are they nurturing relationships with the local referral sources?

- Are they overly reliant on paid referral sources?

- Are they flooded with poor quality leads that is consuming all of their time?

- Is resident turnover high because the leads we get are for high acuity residents with short length of stay?

- How big and active is your lead database?

Do not be tempted to declare victory over the sales drought quite yet! Now comes the hard part.

The plan

People: The right people – sales and revenue oriented from top down.

Strategy: Aligned priorities: sales and occupancy, customer service and quality, then adjusting rate and cost control to build margin.

Execution: Plan your flight and fly your plan! Be consistent in executing the plan and maintaining your priorities in all we do Customer first – revenue generation- then cost control mainly payroll.

Cash: Managing cash to drive revenues is not the most frugal financial decision, expense control etc. Free cash is life blood of revenue for advertising, payroll etc. You can realign priorities once revenue is on track can increasing.

Positive cash flow is a result of good sales and reasonable management, it is not a goal unto itself.

Implementing drastic change is time consuming and challenging:

- Staff will most likely be resistant – we nearly always find that existing staff is unwilling or unable to implement the needed changes, resulting in substantial turnover: a timely and costly process.

- Reputations take a long time to build or rebuild – the building financial struggles are likely widely known in the community. The building may need to be rebranded to announce to the community that big changes are happening.

- Relationship with referral sources take a long time to build. By referring resident to you, your referral resources are aligning their reputation with yours. That requires them to trust that your building is the best choice. Building that trusting relationship takes time and concerted attention.

- Residents may leave as they may not like the changes you are making, they may feel loyalty to a departing employee, or they may no longer be able to afford a building that is being course corrected.

- Expenses may rise as new image is created and new staff is hired.

Operational Whiplash

We refer to this period of the operational turnaround process as the whiplash period, a period that may see the situations worsen as you assess and adjust to position for future success. From our experience the whiplash period takes approximately six months. From there building can begin.

The time it will take from there to complete the operational turnaround of the property is dependent on your particular situation and you will need to answer the following questions:

- What does stabilization mean for my building? Will you be profitable at 70% occupancy? 80%? 100%?

- How many more units will need to be filled to get to that goal?

- How many residents do we lose each month and has that been factored into your projections? Moving in four new residents a month may be great, but not enough if you are also losing four residents.

- Are your current residents paying appropriate rates or will they need to be adjusted?

- How big is the local market and how big and active is my lead database?

In general, if you can focus on being exceptionally good at only 2 things Revenue generation and payroll control you can reach breakeven and profitability. These two items are multifaceted, complicated, and critical. Most other items on the P&L are of marginal impact to profitability and should be addressed after success is achieved in positive cashflow through increased revenues.

Turning around a financially struggling assisted living is a timely, expensive process. It is rare to find a struggling building that only needs a few minor tweaks to reach potential. Most financial troubles stem from a lack of focus on the sales process. A process that must be learned, monitored, and practiced persistently.

Alcore Senior has decades of experience successfully turning around underperforming buildings through wholistically revamping the sales and marketing process and providing onsite staff continuous, concentrated oversight. Our intense, systematic approach has repeatedly proven itself through various economic conditions and across many communities with varying demographics.

Please reach out to info@alcoresenior.com for more information.